Retroactive tax credit may be applied to windows doors and skylights installed between december 31 2016 to december 31 2017.

Federal tax credit for window replacement 2017.

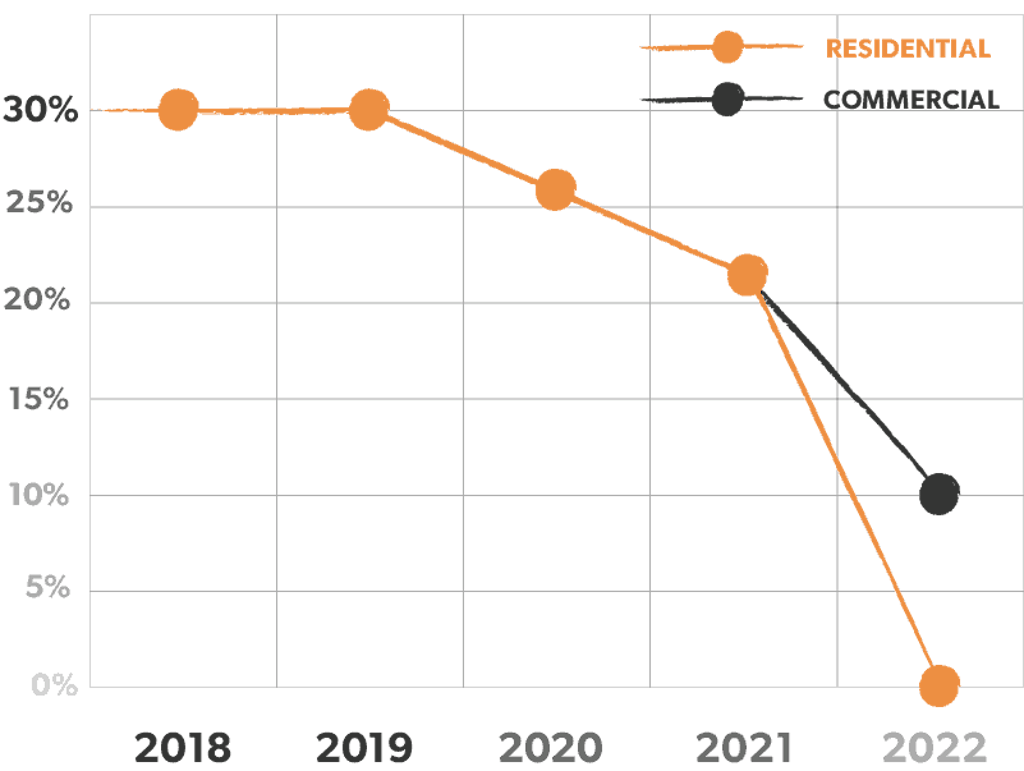

Through the 2020 tax year the federal government offers the nonbusiness energy property credit.

What is a tax deduction.

And it doesn t need to be a replacement either installing a new window where there wasn t one previously like in an addition qualifies.

Save your receipts and the manufacturer s certification statement.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

Here s what you need to know when filing for tax years 2019 2020 and 2021.

Taxpayers may only use 200 of this limit for windows.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

Homeowners who made energy efficient improvements to their home can qualify for a federal tax credit but you must meet certain rules.

The tax credit is an extension of the 26 u s c.

Here are some key facts to know about home energy tax credits.

Claim the credits by filing form 5695 with your tax return.

Tax credit does not include installation costs.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Residential energy credits pdf.

25c tax credit which means all previous federal tax credits are a lifetime maximum credit.

Irs tax tip 2017 21 february 28 2017 taxpayers who made certain energy efficient improvements to their home last year may qualify for a tax credit this year.

10 of the cost up to 500 but windows are capped at 200.

Federal tax credit archives.

If a combination of windows skylights and doors are purchased then the total maximum credit is 500 of which 200 is the maximum allowable for windows and skylights 5.

Accesswire march 2 2020 the international window film association iwfa announced that a federal tax credit of up to 500 is available for qualifying residential window film.

A refundable tax credit means you get a refund even if it s more than what you owe.

That means if you made any qualifying home improvements in 2017 such as replacing doors and windows you can claim them on your taxes this year using irs form 5695.

A nonrefundable tax credit means you get a refund only up to the amount you owe.

Subtract tax deductions from your income before you figure the amount of tax you owe.

Find credits and deductions for businesses.

Federal income tax credits and other incentives for energy efficiency.