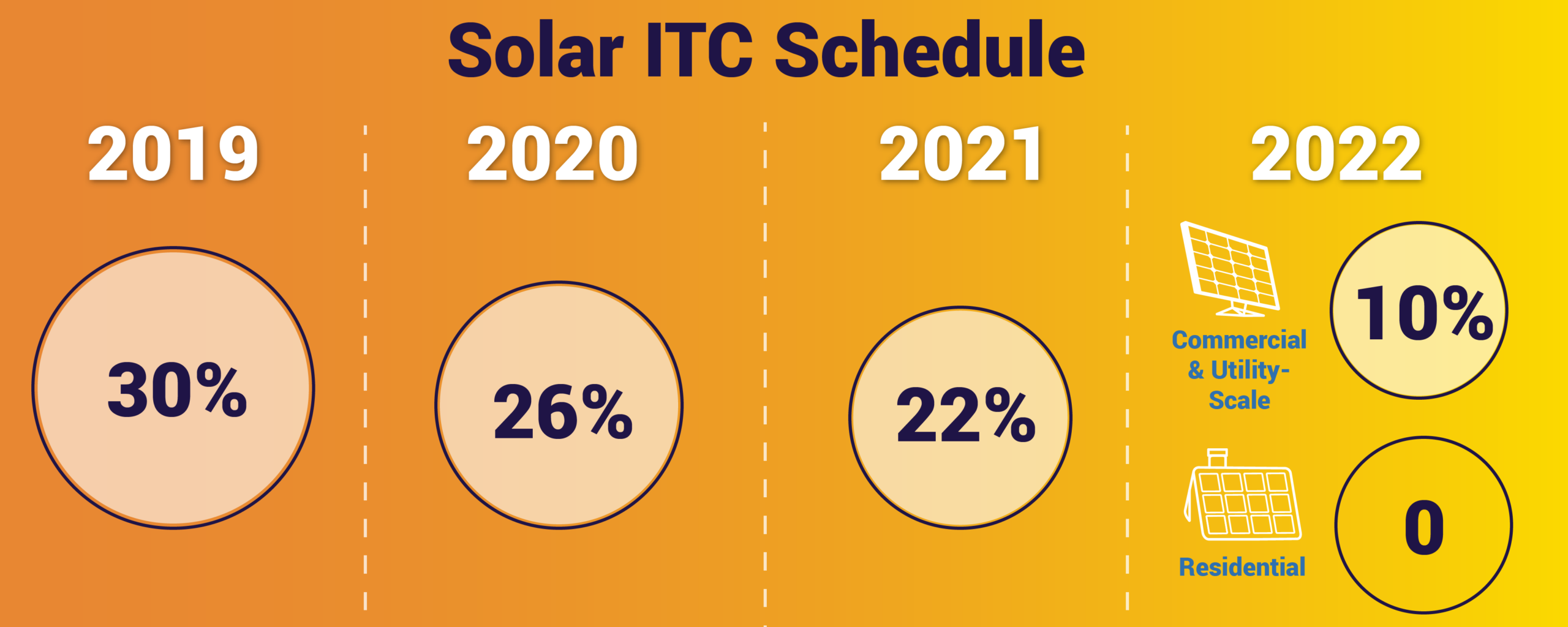

Both homeowners and businesses qualify for a federal tax credit equal to 26 percent of the cost of their solar panel system minus any cash rebates.

Eversource credit or rebate and solar panels.

Connect with eversource and mass save for technical resources and incentives to help you save.

Officially known as the residential solar investment program and administered by the connecticut green bank this rebate is worth 0 463 per watt of solar installed up to 10kw.

We know that solar and other renewable energy sources can help you reduce your energy bill and your carbon footprint.

60 kw or less.

For eversource customers in massachusetts solar panel system size determines which of the three classes a net metering customer falls under.

Vsds variable speed drives pump motor and fan vsds will save energy and extend the life of equipment.

Understanding net metering earn possible bill credits for producing more solar energy than you use.

Save on lighting lighting lighting controls led lighting and lighting controls provide significant energy and maintenance savings while helping your business shine.

Eversource offers the top utility net metering program in new hampshire.

We stand ready to help you to connect your solar power safely into eversource s electric grid to produce clean energy for your home or business.

What are ct s top solar tax credits and rebates.

We re proud to be recognized as one of the greenest energy companies in the nation.

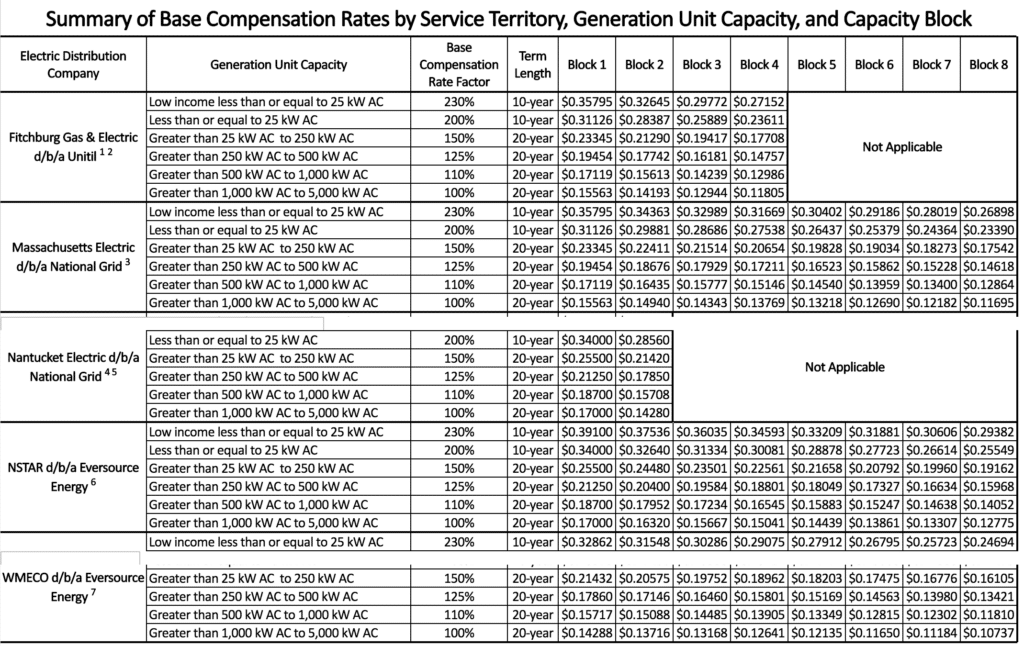

Electric customers of eversource in connecticut who install new qualifying renewable energy projects ranging from rooftop solar panels to fuel cells now have an opportunity to sell the qualified connecticut class i renewable energy credits recs created from their projects to eversource under a long term 15 year contract.

Any solar energy installation less than 1 megawatt mw in size including the vast majority of residential systems qualifies to receive solar bill credits for sending energy back to the grid.

That is a homeowner who invests in a 5kw system would receive 2 315 right off the bat.

Upgrade replace or install hvac equipment incentives for high efficiency gas or electric equipment for business of all sizes.

We created these pages to raise your awareness and understanding of solar energy.

Connecticut has a plethora of solar programs including.

The federal government provides a solar tax credit known as the investment tax credit itc that allow homeowners and businesses to deduct a portion of their solar costs from their taxes.

This means that for every excess kwh a system panel system generates you receive a credit worth 7 8 cents on your bill.

Learn more at mass save.

.jpg?sfvrsn=4efcd462_2)