Under the internal revenue code miscellaneous itemized deductions are allowed for individuals which include trusts and estates only to the extent that the aggregate deductions exceed 2 percent of adjusted gross income.

Estate deductions subject to 2 floor.

Although notice 2018 61 allows estates and trusts to continue to take deductions for administration expenses that would not have been incurred if the property were not held in the estate or trust the first category of expenses not subject to the 2 floor the notice does not say whether beneficiaries may take deductions for those expenses when an estate or trust terminates.

These regulations which are essentially unchanged from the much maligned proposed regulations first issued in 2007 govern trust and estate costs subject to the 2 percent floor on miscellaneous itemized deductions.

Examples of itemized deductions not subject to the 2 floor include costs related to fiduciary income tax returns and estate tax returns probate court costs and certain appraisal fees.

Miscellaneous itemized deductions are those deductions that would have been subject to the 2 of adjusted gross income limitation.

For deductions that are subject to the 2 rule you may only deduct the part of the expenses that exceeds 2 of your adjusted gross income agi.

Many of these deductions will be subject to the 2 percent.

The regulations apply to tax years beginning on or after jan.

Deductions in excess of income in the final year of a trust or estate pass through to beneficiaries as miscellaneous itemized deductions even if the expenses would otherwise be characterized as itemized.

E read as follows.

You can still claim certain expenses as itemized deductions on schedule a form 1040 1040 sr or 1040 nr or as an adjustment to income on form 1040 or 1040 sr.

For purposes of this section the adjusted gross income of an estate or trust shall be computed in the same manner as in the case of an individual except that the deductions for costs which are paid or incurred in connection with the administration of the estate or trust and would not have been incurred if the property were not held in such trust or estate shall be.

This publication covers the following topics.

However certain expenses of an estate or trust are not subject to the 2 percent floor.

When filing form 1040 or form 1041 for a decedent estate or trust you must determine how to deduct administration fees.

Deductions for attorney accountant and preparer fees are limited on schedule a of form 1040.

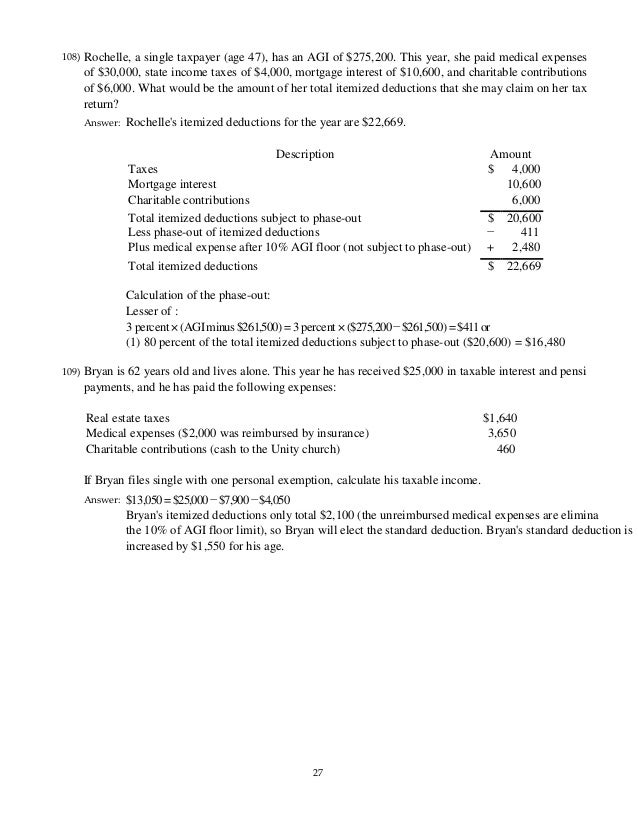

Under knight fees paid to an investment adviser by a nongrantor trust or estate are generally miscellaneous itemized deductions subject to a floor of 2 of adjusted gross income agi rather than fully deductible as an expense of administering an estate or trust under sec.